NZ RP6/RP9 2021-2025 free printable template

Show details

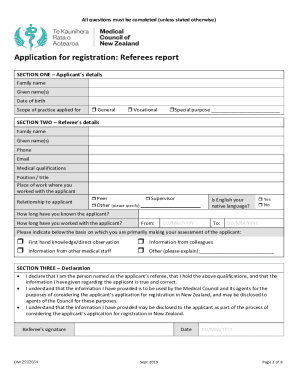

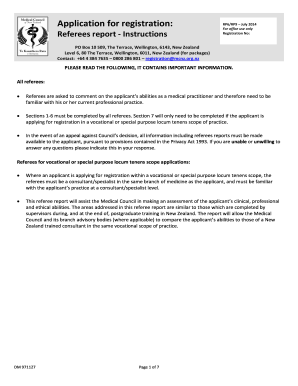

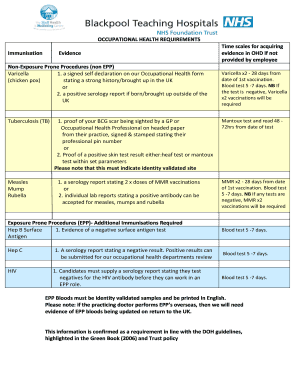

RP6: Referee report Purpose of this referee report The Medical Council of New Zealand's (Councils) principal purpose is to protect the health and safety of members of the public through ensuring that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rp6 referees report form

Edit your new zealand rp6 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rp6 report blank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing registration zealand dm online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form rp6 report. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ RP6/RP9 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nz rp9 download form

How to fill out NZ RP6/RP9

01

Gather all necessary personal and financial information.

02

Fill out your personal details including name, address, and date of birth.

03

Provide details of your employment history and any previous visas if applicable.

04

Include information regarding your qualifications and skills.

05

Specify the purpose of your application clearly.

06

Ensure all information is accurate and complete to avoid delays.

07

Attach required documents, such as proof of identity and qualifications.

08

Review your application for any errors before submission.

09

Submit the application form through the appropriate channel.

Who needs NZ RP6/RP9?

01

Individuals applying for residency in New Zealand.

02

Foreign nationals seeking to stay longer in New Zealand for work or study.

03

People transitioning from temporary visas to permanent residency.

04

Applicants looking to bring family members to New Zealand.

Video instructions and help with filling out and completing new zealand rp9

Instructions and Help about nz form rp6 blank

Fill

rp9 app referees form

: Try Risk Free

People Also Ask about rp9 referees online

What should be included in a redundancy letter?

You should include: how they scored in the selection criteria and why they received that score. their notice period and leaving date. how much redundancy pay they'll get and how you calculated it. any other pay due to them, for example holiday pay. when and how you'll pay them. how they can appeal the redundancy decision.

What is a redundancy form?

Redundancy is a form of dismissal from your job. It happens when employers need to reduce their workforce.

What are genuine reasons for redundancy?

Fair reasons for redundancy asked for one of your rights at work - for example asking for minimum wage, holiday or maternity leave. took action about health and safety - for example making a complaint. are a whistleblower - you've reported your employer for doing something illegal.

Can you ask for redundancy in Ireland?

Your employer cannot select you for redundancy unless they can prove they followed a fair process. Your employer cannot select you for redundancy for personal or non-job-related reasons.

Can I ask my employer to make me redundant?

To volunteer for redundancy, you can ask your employer. It's a good idea to put it in writing. You should follow your employer's policy or procedure for voluntary redundancy, if they have one. Your employer does not have to agree to make you redundant as they will be considering the needs of the business as a whole.

What are reasonable grounds for redundancy?

The reasons for selecting employees to be made redundant have to be fair and genuine, legitimate reasons for redundancy include: Attendance history and punctuality. Skill and experience level. Performance history.

How do I claim redundancy in Ireland?

If your employer has not paid your redundancy lump sum, you should apply to your employer for it using form RP77 (pdf). If your employer cannot pay or they are insolvent, you can apply to get the payment from the Government under the Social Insurance Fund.

How do you negotiate redundancy in Ireland?

Set out your objectives. Check your contract of employment. Check your employer's redundancy payout policies. Decide your negotiating strategy. (Almost) always seek to negotiate the financial values. Be clear and polite when negotiating the redundancy payout. Take good notes of meetings. Do your research.

How is redundancy paid in Ireland?

An eligible employee is entitled to two weeks normal weekly remuneration for every year of service, plus a bonus week. The redundancy lump sum calculation is based on the worker's length of reckonable service and weekly remuneration, which is subject to a ceiling of €600 per week.

How do I know if I will be made redundant?

Here are twelve signs which we here at Softweb think might help you determine if you're about to be made redundant: Monitor the mood in the office. Meetings behind closed doors. Extreme and pointless cost-cutting. Tightening up on expenses. Your workload decreases. Your productivity decreases.

What are the 5 fair reasons for redundancy?

What constitutes grounds for redundancy? The need for the worker has diminished or ceased. New systems in the workplace. The job no longer exists because other workers are doing the work you carried out. The workplace has closed or is closing down. The business moves. The business is transferred to another employer.

How much is redundancy pay UK?

If you were made redundant on or after 6 April 2022, your weekly pay is capped at £571 and the maximum statutory redundancy pay you can get is £17,130.

What is the correct process for redundancy?

Your employer has to follow a fair redundancy process if you'll have worked for them for at least 2 years by the time your job ends. You should be invited to at least 1 individual meeting with your employer to discuss redundancy. Apart from your individual meeting there isn't a set process.

What are the 5 fair reasons for dismissal under the employment Rights Act?

Reasons you can be dismissed Not being able to do your job properly. You may not be able to do your job properly if, for example, you: Illness. Redundancy. Summary dismissal. A 'statutory restriction' It's impossible to carry on employing you. A 'substantial reason'

Can I ask for voluntary redundancy Ireland?

Compulsory and non-compulsory redundancy Before an employer formally goes through the redundancy procedure required by legislation (compulsory redundancy), they can decide to offer a package to encourage employees to volunteer to leave their roles. This is sometimes known as non-compulsory redundancy.

What does redundant mean in a job?

Redundancy is dismissal from your job, caused by your employer needing to reduce the workforce. Reasons could include: new technology or a new system has made your job unnecessary. the job you were hired for no longer exists. the need to cut costs means staff numbers must be reduced.

What are the 5 stages of redundancy?

Basically, there are five main stages to consider during the redundancy process: Stage 1: Preparation. Stage 2: Selection. Stage 3: Individual Consultation. Stage 4: Notice of Redundancy and Appeals. Stage 5: The Termination Process.

How do I find out if I am entitled to redundancy?

Who can get statutory redundancy pay. You'll get statutory redundancy pay if you: have been employed by your employer for 2 years continuously. have lost your job because there was a genuine need to make redundancies in your workplace.

Do you need a reason to be made redundant?

Yes, employers need to be able to explain and justify the reasons for making an employee redundant. If the employee considers these to be unfair, they could lodge an appeal and/or bring an employment tribunal claim for unfair dismissal and/or discrimination against the employer.

Can I ask my employer for redundancy Ireland?

An employee who has been laid off for 4 or more consecutive weeks can give a written notice to his employer indicating his intention to claim redundancy. (Section 12 Redundancy Payments act, 1967).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is rp6 form?

There does not appear to be a widely known or specific term referring to "rp6 form." It is possible that you may be referring to a specific form or document related to a particular context or industry. Without further information, it is not possible to provide a more precise answer.

Who is required to file rp6 form?

The RP6 form is a tax return form used in the United Kingdom. It is mainly filed by individuals who fall under the self-assessment tax system. These individuals include:

1. Self-employed individuals or sole traders.

2. Partners in a business partnership.

3. Directors of limited companies.

4. Landlords who receive rental income.

5. Individuals with income from investments or savings, such as dividends or interest.

6. High-income earners whose income is above the threshold for paying higher-rate tax.

7. Individuals with foreign income or gains over a certain threshold.

8. Trustees or personal representatives of a deceased person's estate.

9. Individuals with complex tax affairs that cannot be handled through a PAYE (Pay As You Earn) system.

It is important for individuals to check whether they are required to file the RP6 form based on their specific circumstances and consult with a tax professional if needed.

How to fill out rp6 form?

To fill out the RP6 form, follow these steps:

1. Download the official RP6 form from the relevant website or obtain a physical copy from a government office or service center.

2. Read the instructions on the form carefully to understand the information you will need to provide and the sections you need to complete.

3. Start by completing the personal details section, which typically includes your full name, contact details, address, date of birth, and relevant identification numbers such as a social security or national insurance number.

4. Next, provide information regarding your employment status, including your current or previous employer's details, occupation, industry, and income.

5. If applicable, fill in the section related to your partner or spouse, including their personal details and employment information.

6. Proceed to complete the section related to your children or dependents, if relevant, providing their names, ages, and any other requested details.

7. If you have received any benefits or assistance from government or other organizations, complete the relevant section, providing details of the type of benefits received, the duration, and any supporting information required.

8. Take note of any additional attachments or supporting documentation that may be required, such as identification documents, proof of income, or relevant statements.

9. After completing all the necessary sections, review the form for accuracy and ensure that all sections have been filled in correctly and completely.

10. Sign and date the form at the designated area, and make any additional copies as required by the instructions.

11. Submit the completed form to the appropriate government office or service center according to their guidelines, either physically or electronically, as specified.

What is the purpose of rp6 form?

The purpose of RP6 form varies depending on the context. It could refer to different forms used in different industries or organizations. Here are a few examples:

1. Tax Form: In the United Kingdom, RP6 refers to a tax form used by employers to provide information about employee deductions, expenses, and benefits.

2. Vehicle Registration: In some countries, RP6 may refer to a form used for vehicle registration or transfer of ownership.

3. Immigration: RP6 may also be associated with immigration forms used in certain countries for visa applications, residency permits, or other related purposes.

It is important to specify the specific industry or context to provide a more accurate answer for the purpose of the RP6 form in question.

What information must be reported on rp6 form?

The RP6 form, also known as the Accident Report Form, must include the following information:

1. Personal information: Name, address, and contact details of the person reporting the accident.

2. Accident details: Date, time, and location of the accident.

3. Parties involved: Names, addresses, and contact details of all individuals involved in the accident (including drivers, passengers, and pedestrians).

4. Vehicle details: Make, model, registration number, and insurance details of all vehicles involved in the accident. This includes information about any third party vehicles.

5. Accident description: A detailed account of how the accident occurred, including the sequence of events leading up to the accident and any contributing factors.

6. Injuries and damages: Information about any injuries sustained by individuals involved in the accident and the extent of the damage to vehicles or property.

7. Witnesses: Names, addresses, and contact details of any witnesses to the accident.

8. Police involvement: If the police were called to the scene, information about the responding officers and any police report numbers.

9. Insurance details: Information about the insurance companies and policy numbers of all parties involved.

10. Signature and date: The form must be signed and dated by the person reporting the accident.

Where do I find rp6 referees online?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the registration zealand dm online in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I complete rp9 referees print online?

pdfFiller has made it easy to fill out and sign rp9 instructions fillable. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit rp9 referees straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing rp6 referees print right away.

What is NZ RP6/RP9?

NZ RP6/RP9 refers to the New Zealand tax forms used for reporting income tax for specific types of taxpayers, primarily for those engaged in agricultural activities. They help in the calculation and reporting of income tax obligations.

Who is required to file NZ RP6/RP9?

Farmers and agricultural businesses in New Zealand are required to file NZ RP6/RP9 if their income falls under the applicable categories defined by the New Zealand tax regulations.

How to fill out NZ RP6/RP9?

To fill out NZ RP6/RP9, the taxpayer needs to provide accurate income numbers, expenses, and any relevant deductions specific to their agricultural activities. It is advisable to refer to the guidelines provided by the New Zealand Inland Revenue Department.

What is the purpose of NZ RP6/RP9?

The purpose of NZ RP6/RP9 is to enable the proper reporting and calculation of income tax for agricultural entities, ensuring compliance with New Zealand tax laws.

What information must be reported on NZ RP6/RP9?

NZ RP6/RP9 requires reporting of income earned, expenses incurred, assets owned, liabilities, and any relevant tax credits or deductions applicable to the agricultural business.

Fill out your NZ RP6RP9 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nz Form Referees is not the form you're looking for?Search for another form here.

Keywords relevant to form rp6 referees

Related to rp6 application print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.